Understanding the strategic allocation of trade spend Vs marketing spend is crucial for driving growth and profitability. As a trade marketing expert with over a decade of experience, I’ve seen firsthand how optimizing these investments can make or break a brand’s success.

In this comprehensive guide, we’ll dive deep into the key differences between trade spend and marketing spend, explore proven strategies for measuring ROI, and share actionable insights to help you make informed decisions in the post-pandemic retail environment.

Key Takeaways

- Trade and marketing spending serve distinct but complementary purposes in driving growth and profitability.

- Effective budget allocation requires deeply understanding each spending category’s objectives, components, and KPIs.

- Brands must leverage advanced analytics and cross-functional collaboration to optimize real-time spending.

- Adapting to emerging trends and technologies is critical for staying ahead in the post-pandemic retail landscape.

Trade and Marketing Spend

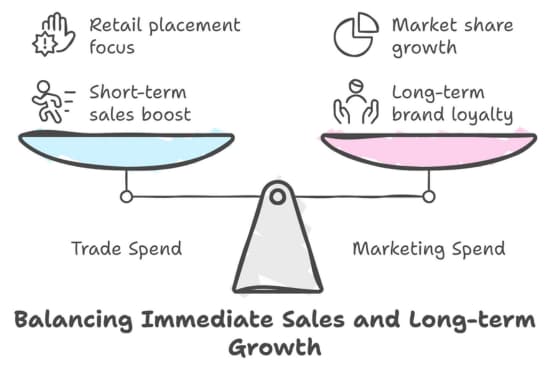

At its core, trade spend refers to the investments made by brands to promote their products at the retail level. In contrast, marketing spending encompasses initiatives to build brand awareness and engage consumers directly.

Both trade spend management and marketing spending play critical roles in driving sales and market share but require different approaches and metrics for success.

For example, consider the case of PepsiCo, which has long been known for its strategic balance of trade and marketing spend.

The beverage giant has consistently outperformed competitors and solidified its market leadership by investing in targeted trade promotions with key retailers like Walmart and Kroger while running iconic consumer marketing campaigns like the Pepsi Challenge.

Definitions and Context

To set the stage for a deeper analysis, let’s clarify the definitions of trade spend and marketing spend:

- Trade Spend: Optimize your trade spend for better effectiveness. This includes tactical investments such as shelf space fees, in-store displays, price discounts, and retailer-specific promotions. The primary goal is to drive short-term sales and secure prime retail placement.

- Marketing Spend: These are strategic initiatives focused on building long-term brand equity, customer loyalty, and market share. Examples include advertising campaigns, sponsorships, content marketing, and social media engagement.

While there are some overlaps, such as co-branded promotions targeting retailers and consumers, understanding the distinct objectives of each spending category is essential for strategic budget allocation and effective trade spend management.

Objectives of Each Spend Type

The primary objectives of trade spend are to drive immediate sales lifts, strengthen relationships with key retail partners, and ensure optimal product availability and visibility in-store.

By contrast, marketing spending aims to build enduring brand awareness, acquire new customers, and foster long-term loyalty.

| Trade Spend Objectives | Marketing Spend Objectives |

|---|---|

| Short-term sales boosts | Long-term brand building |

| Retail partner relationships | Customer acquisition & loyalty |

| Product distribution & availability | Market share growth |

A classic example of effective trade spend is Frito-Lay’s “Snack City” program, which creates dedicated in-store displays featuring a variety of the brand’s products.

Frito-Lay consistently drives incremental revenue from promotions by securing prime real estate and offering retailers attractive margins.

Components of Trade Spend

Trade spend encompasses a range of tactics designed to incentivize retailers and drive immediate sales. Some common components include trade promotion management strategies.

- Slotting fees: Payments to secure prime shelf space and placement.

- Temporary price reductions (TPRs): Short-term discounts to boost sales.

- Promotional allowances: Funds provided to retailers to feature products in circulars or displays.

- Co-op advertising: Shared advertising costs with retailers to promote specific products or offers can enhance trade promotion management strategies.

Brands must carefully evaluate each component’s ROI and adapt their strategies based on real-time performance data.

For instance, Mondelez International leverages advanced analytics to optimize its trade spend, reallocating funds from underperforming promotions to high-impact activities with proven trade promotion ROI.

Components of Marketing Spend

Marketing spend involves a mix of traditional and digital tactics to engage consumers and build long-term brand equity. Key components include:

- Advertising: TV, print, radio, out-of-home, and digital ad campaigns can complement trade promotion management efforts.

- Content marketing: Blog posts, videos, podcasts, and other value-added content.

- Social media marketing: Paid and organic campaigns on Facebook, Instagram, Twitter, and other platforms.

- Influencer partnerships: Collaborations with industry thought leaders and social media influencers.

The most effective marketing strategies seamlessly integrate multiple tactics to deliver a cohesive brand message. For example, Nike’s “Dream Crazy” campaign featuring Colin Kaepernick spanned TV ads, social media activations, and experiential events, all centered around the brand’s core values of innovation and empowerment.

Measuring ROI for Trade Spend

To optimize trade spend, brands must diligently track key performance indicators (KPIs) such as:

- Incremental sales lift

- Return on investment (ROI)

- Promotional efficiency (incremental sales per dollar spent)

- Retail execution metrics (e.g., display compliance)

By leveraging marketing analytics tools and trade promotion optimization software, brands can gain granular insights into the performance of each promotional tactic and make data-driven decisions to maximize ROI.

A standout example is Unilever’s use of artificial intelligence to optimize its trade spend. The consumer goods giant developed predictive models that guide strategic decisions around promotional timing, duration, and pricing by analyzing vast data from past promotions.

As a result, Unilever has achieved significant improvements in trade spend efficiency and overall profitability.

Measuring ROI for Marketing Spend

Evaluating the effectiveness of marketing spend requires a holistic view of both short-term and long-term metrics. Key indicators include:

- Brand awareness and recall

- Customer acquisition cost (CAC)

- Customer lifetime value (CLV)

- Engagement rates (e.g., clicks, shares, comments)

- Conversion rates (e.g., sales, sign-ups, downloads)

Brands increasingly rely on multi-touch attribution models and advanced analytics platforms to accurately attribute revenue to specific marketing initiatives.

These tools help marketers understand the complex customer journey and optimize spending across channels and tactics.

One brand that has mastered this approach is Procter & Gamble (P&G). By leveraging sophisticated marketing mix modelling and attribution techniques, P&G continuously refines its marketing investments to drive maximum impact.

The company’s “Thank You, Mom” Olympic campaign, which spanned multiple years and channels, exemplifies how a well-orchestrated marketing strategy can drive short-term sales and long-term brand loyalty.

Comparative Analysis: Trade vs. Marketing Spend

While both trade spending and marketing spending are essential for driving growth, they differ in several key aspects:

| Factor | Trade Spend | Marketing Spend |

|---|---|---|

| Timeframe | Short-term | Long-term |

| Primary target | Retailers | Consumers |

| Key metrics | Sales velocity and distribution are key factors in managing trade spending effectively. | Brand equity, customer loyalty |

| Budget allocation | Typically higher (10-20% of revenue) | Typically lower (5-10% of revenue) |

Striking the right balance between trade and marketing spend is critical for success. When allocating budgets, brands must consider their growth stage, market position, and competitive landscape.

Budget Allocation Recommendations

While there’s no one-size-fits-all approach to budget allocation, here are some general guidelines based on industry benchmarks and best practices:

- For early-stage brands: Focus on marketing spend to build awareness and trial.

- For established brands: Prioritize trade spend to defend market share and drive incremental sales.

- For challenger brands: Strike a balance between trade and marketing spend to disrupt the status quo.

To optimize spend across both categories, brands should embrace a collaborative, cross-functional approach that aligns sales, marketing, and finance teams around shared goals and metrics.

Industry-Specific Insights

The optimal mix of trade and marketing spend varies widely by industry. For example, understanding the complexities of trade can lead to better trade spend management.

- In the CPG sector, trade spend often accounts for 20-30% of revenue, while marketing spend typically ranges from 5-10%.

- In the technology industry, marketing spend tends to be higher (10-20% of revenue), while trade spend is relatively lower (5-10%).

Across all industries, the rise of e-commerce and Direct-to-consumer strategies can help manage trade spending more effectively. (DTC) models are disrupting traditional spending patterns.

Brands must adapt their strategy to account for new digital touchpoints and dynamic ad spending strategies that optimize real-time investments.

Common Pitfalls and Challenges

Despite the critical importance of trade and marketing spend, many brands struggle to optimize their investments due to common pitfalls such as:

- Siloed decision-making: Lack of collaboration between sales, marketing, and finance teams.

- Short-term focus: Optimize your trade spend to achieve immediate results. Overemphasis on immediate sales lifts at the expense of long-term brand building.

- Data fragmentation: Difficulty integrating data from multiple sources to gain a holistic view of performance.

- Resistance to change: Reluctance to embrace new technologies and ways of working.

To overcome these challenges, brands must foster a culture of experimentation, agility, and continuous learning. This requires breaking down organizational silos, investing in advanced analytics capabilities, and empowering teams to make data-driven decisions in real-time.

Implementation Considerations

To effectively implement a balanced trade and marketing spending strategy, brands should:

- Align on shared goals and KPIs across sales, marketing, and finance teams.

- Invest in robust data management and analytics platforms.

- Develop processes for continuous monitoring, testing, and optimization.

- Foster a culture of experimentation and learning.

- Collaborate closely with retail partners to develop win-win strategies.

By taking a holistic, data-driven approach to trade and marketing spend, brands can unlock significant growth opportunities and build enduring competitive advantage.

Conclusion and Future Trends

As the retail landscape continues to evolve after the COVID-19 pandemic, brands must navigate the complexities of trade and adapt their marketing strategies to stay ahead of the curve. Key trends to watch include:

- The accelerated shift to e-commerce and omnichannel retail.

- The growing importance of personalization and targeted promotions.

- The rise of trade spend management. artificial intelligence and machine learning for real-time optimization.

- The increasing emphasis on sustainability and purpose-driven marketing.

By staying attuned to these trends and continually refining their approach to trade and marketing spend, brands can position themselves for long-term success in an increasingly dynamic and competitive marketplace.